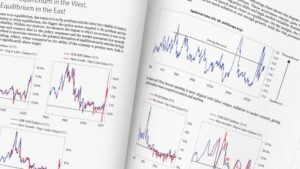

The tightening cycle began roughly one year ago. It takes about that long for a tightening to have significant economic impacts, and signs are emerging that the effects are now spreading and deepening. Damage to the banking system is a manifestation of the tightening and is now likely to be a contributor. Economies rely on the steady flow of liquidity from cash and credit to assets and spending. This liquidity pipeline runs from the central bank as the originator, through the financial system as an intermediary, to the markets, and finally to spending and income. The combination of central banks raising interest rates and draining reserves with banks experiencing more constrained deposit and capital conditions and now tightening credit standards is very likely to constrain the flow of money and credit to markets and the economy, with impacts on spending and income. Manifestations of this are now showing up in the data, as we’ve described in recent research.

Source: An Update from Our CIOs: The Tightening Cycle Is Beginning to Bite