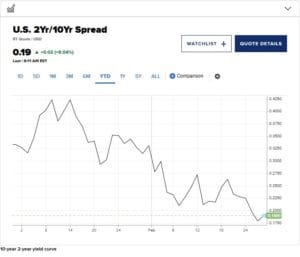

🚨 The inverted yield curve, a reliable recession signal, has reappeared. This could impact multifamily real estate in Greater Boston by tightening credit availability and raising borrowing costs. An inverted yield curve indicates that short-term interest rates are higher than long-term rates, leading banks to become more cautious in lending. Developers may face challenges in financing new projects, but stabilized rents and strong occupancy rates offer some relief. Strategic planning and creative financing will be key to navigating this uncertain landscape. 🏢📉

Read more → https://www.cnbc.com/2025/02/26/federal-reserves-favorite-recession-indicator-is-flashing-danger-again.html