The Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, rose 0.2% in July, according to the Bureau of Economic Analysis. The core PCE index, which excludes volatile food and energy prices and is considered a better predictor of future inflation, climbed a slightly faster 0.3%, matching Wall Street expectations. While the increase points to ongoing price pressures, likely influenced by higher U.S. tariffs, it’s not expected to deter the Fed from a potential rate cut next month.

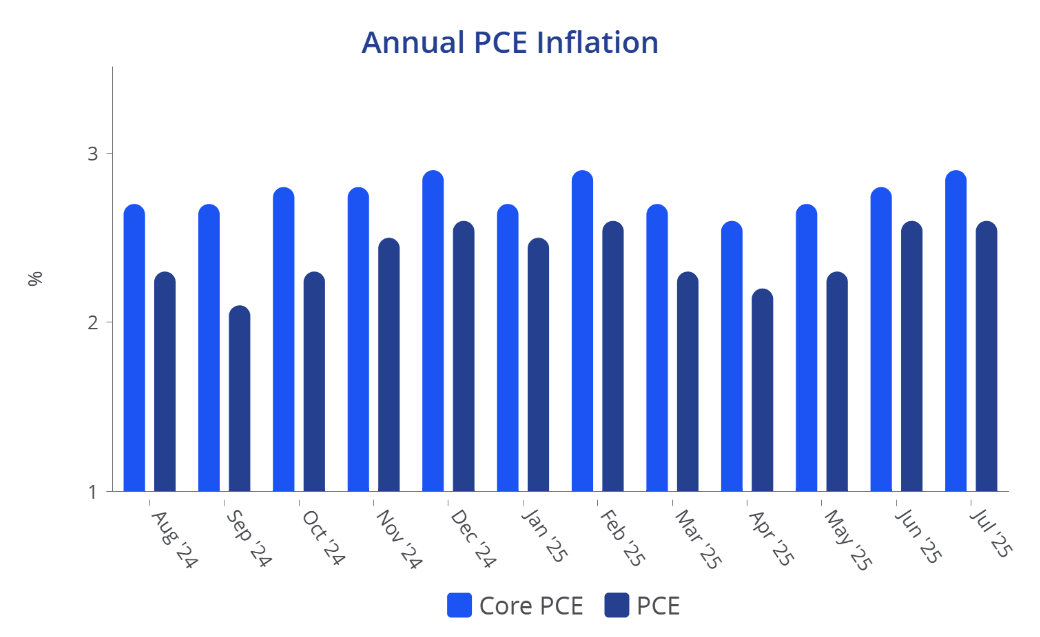

On a year-over-year basis, the overall inflation rate held steady at 2.6%, still above the Fed’s 2% target. Core inflation ticked up to 2.9%, the highest since February.

The PCE report is one of three key data points the Fed will weigh ahead of its September meeting, alongside the upcoming August jobs report and the Consumer Price Index (CPI) due in early September.

Contact Us

"*" indicates required fields