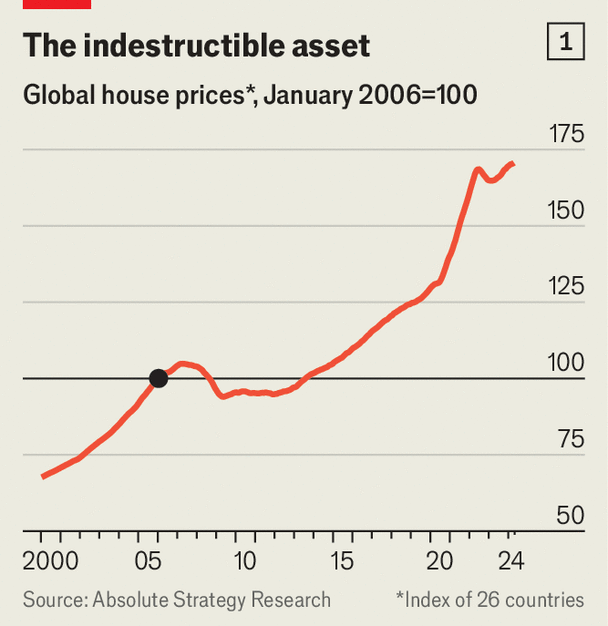

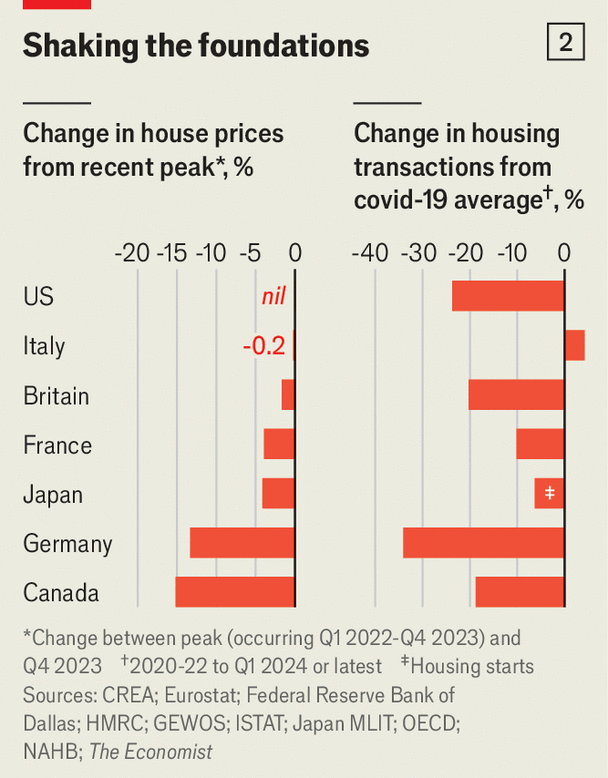

…it is surprising that things have not been more difficult still. Since a trough in 2021, the rate on a typical 30-year mortgage in America has risen by about four percentage points. Rules of thumb derived from the academic literature indicated that nominal house prices would fall by 30-50%. In fact, they have hardly fallen at all in nominal terms. In real terms (ie, adjusted for inflation) global house prices are down by 6% from their peak—but that puts them in line with their pre-pandemic trend. The downturn also claims the crown as the shortest ever, lasting just a few months.

Some worry that high rates will eventually cause a proper crash. Rohin Dhar, a housing expert, has pointed out that many listings in Florida feature the phrase “motivated”, which implies people are selling in a hurry. But in America as a whole, the share of mortgages in delinquency has never been so low, at 1.7%, compared with more than 11% at the height of the global financial crisis of 2007-09.