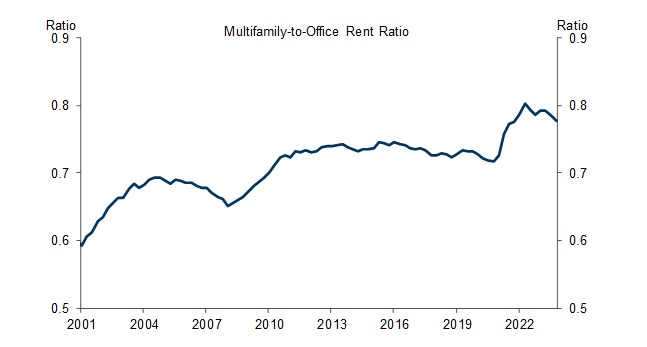

The imbalance between these two markets has driven up the multifamily-to-office rent ratio, a measure that approximates the return for residential investment relative to office investment, to nearly its all-time high since 2000 (Exhibit 4). We expect that this ratio will increase even more in the next few years if the office vacancy rate continues to increase and residential housing supply remains low.

Converting underutilized office space to residential units seems like a natural solution to the structural imbalance. But is it economically feasible? In this week’s Analyst, we assess the feasibility of office-to-multifamily conversion and its economic implications.

The office-to-multifamily conversion rate is quite low, suggesting that there may be substantial financial and physical hurdles to conversion. Only about 0.4% of office space was converted to multifamily per year before the pandemic, and the rate increased to 0.5% in 2023 (Exhibit 7). If the conversion continues at the current pace, it will take another 8 years to convert the 4% of offices that are currently nonviable by our definition.

Source: The Price Is Still Too High for Office-to-Multifamily Conversion (Peng/Viswanathan)