The first quarter of 2023 for the Greater Boston multifamily market was marked by uncertainty and turmoil, with dramatic changes in capital markets, rent growth, and local government policies.

The first quarter of 2023 for the Greater Boston multifamily market was marked by uncertainty and turmoil, with dramatic changes in capital markets, rent growth, and local government policies.

Capital markets saw unprecedented volatility, with seven straight interest rate hikes by the Fed, causing the Federal Funds rate to jump from 0.25% to 4.5% in just nine months, with an additional 50bps coming in Q1. The dramatic increase in interest rates caused institutional lending to all but dry up and local and regional lending standards to tighten up significantly. The rate increases were exacerbated by the failure of Silicon Valley Bank on March 10th, which sent shockwaves through the regional banking system. While sourcing capital in the debt markets is proving challenging, a staggering amount of private capital remains on the sidelines. Real Estate Alert reported 603 funds are seeking $619 billion in equity and have already raised $395 billion.1

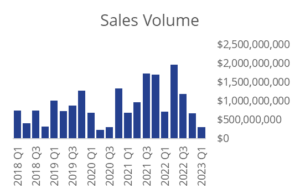

The remarkable amount of available savior capital should allay any fears that there will be blood in the streets in the immediate future as recession looms. Multifamily transactions are down 58.27% YOY and 55.37% since Q4 2022. Pricing has been impacted dramatically as well. Cap rate expansion of 75bps to 100bps resulted in a 10% to 20% decline in values. Transactions that did take place stemmed from sellers who had tangible capital events. Savior capital is in play for these scenarios in the form of mezzanine debt or preferred equity.

The remarkable amount of available savior capital should allay any fears that there will be blood in the streets in the immediate future as recession looms. Multifamily transactions are down 58.27% YOY and 55.37% since Q4 2022. Pricing has been impacted dramatically as well. Cap rate expansion of 75bps to 100bps resulted in a 10% to 20% decline in values. Transactions that did take place stemmed from sellers who had tangible capital events. Savior capital is in play for these scenarios in the form of mezzanine debt or preferred equity.

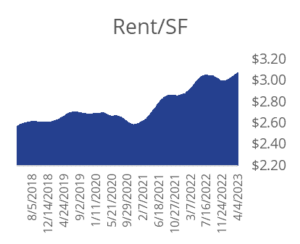

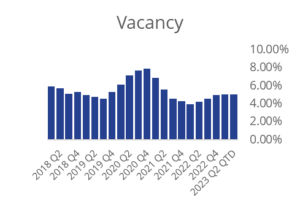

Over the past decade or so, as Boston has transitioned from a provincial backwater to an international city, its dynamic medical, educational, and life science industries have set the stage for a strong multifamily investment and development market. The  confluence of a well-educated populace, (Massachusetts is the most educated state in the Union) and high wage jobs, in a state where the unemployment rate is just 2.9% among college grads, has created a scenario where there is almost no place to live. Occupancy rates for class A units are at 95% and even higher for class B and C assets. Anecdotally, rental unit auctions with multiple applications are common. Rents in the region are up 16.5% over the last 5 years, from $2.57/sf to $3.08/sf, while developers are underwriting $6+/sf in core class A product.

confluence of a well-educated populace, (Massachusetts is the most educated state in the Union) and high wage jobs, in a state where the unemployment rate is just 2.9% among college grads, has created a scenario where there is almost no place to live. Occupancy rates for class A units are at 95% and even higher for class B and C assets. Anecdotally, rental unit auctions with multiple applications are common. Rents in the region are up 16.5% over the last 5 years, from $2.57/sf to $3.08/sf, while developers are underwriting $6+/sf in core class A product.

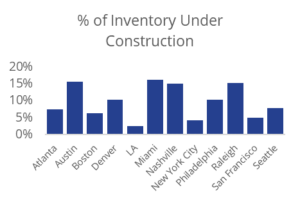

Keeping with demand drivers, developers in the region are introducing additional supply at a historic pace, with 6.4% of existing inventory currently under construction. This additional supply may lead to some rent relief in the area, a welcome event to area renters suffering from rent fatigue, but Boston’s growth pales in comparison to other growing cities like Austin or Miami, which are building mid-teens or more of the current housing inventory. A significant increase in housing supply must be added to Boston’s inventory to keep housing affordable.

Changes in government policy have also demanded consideration in the first quarter’s tumultuous market. Boston‘s current “pro-housing” administration seeks to institute rent control in the form of a 10% cap on rent increases across the City of Boston. Additionally, the administration wants to raise the minimum number of affordable units in new construction from 13% to 20% in 6+ unit buildings. How these policies will affect the market is still up in the air, as they are still in their infancy, but both issues must be considered carefully as they are likely to impact future policies in surrounding communities.

The market is in a dynamic and challenging position marked by uncertainty, volatility, and change. Boston’s unique market conditions offer excellent opportunities, but investors must pay close attention to volatile capital markets, game changing governmental policies, and dynamic supply/demand circumstances. Multifamily investors who can successfully navigate these challenges can and will reap significant rewards in this exciting and constantly evolving market.

- Quinn, R. (Ed.). (2023, March 21). Good Math, Bad Headlines In Fund Universe. greenstreet.com. Retrieved April 11, 2023, from https://my.greenstreet.com/news/articles/213807