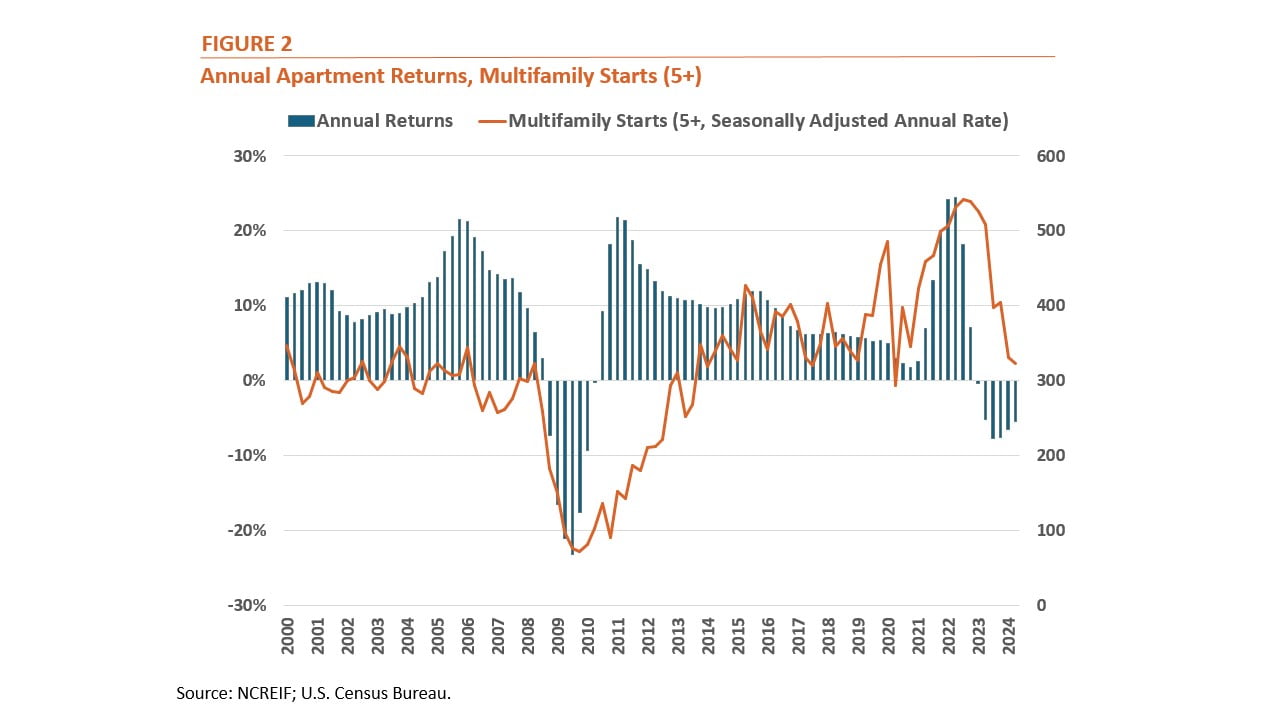

Record-high rent growth in late 2021 and early 2022 was followed by the highest level of multifamily construction since the late 1980s. Multifamily starts rose 14.9% in 2022 to 531,000 units, according to data from the U.S. Census Bureau, their highest level since 1986. A logical conclusion would be that this rent growth fueled developer interest in the asset class, causing construction to increase. This conclusion is also reinforced by the fact that in many metro areas where a lot of development has been occurring, starts have begun to decrease significantly.

Yet, developers are incentivized not just by current rents but also by the expectation of future net operating income (rents minus operating expenses) – as well as by the cost of debt and equity capital – all of which get reflected in the price of apartment properties.