The strain of higher interest rates is creating sleepless nights for some commercial real estate owners and operators these days. On the flip side, there is significant capital eagerly lining up to take advantage of market dislocation.

Big-name managers such as Blackstone, Brookfield Asset Management, Ares, and Starwood are among those that have completed or are actively raising mega-funds targeting opportunistic strategies. For example, Brookfield is actively raising capital for its fifth vintage global opportunistic real estate fund, Brookfield Strategic Real Estate Partners V, which reportedly has a target raise of $15 billion. Office REIT SL Green Realty also is throwing its hat in the ring with a recent announcement that it planned to start fundraising for a $1 billion New York City-focused opportunity debt fund.“

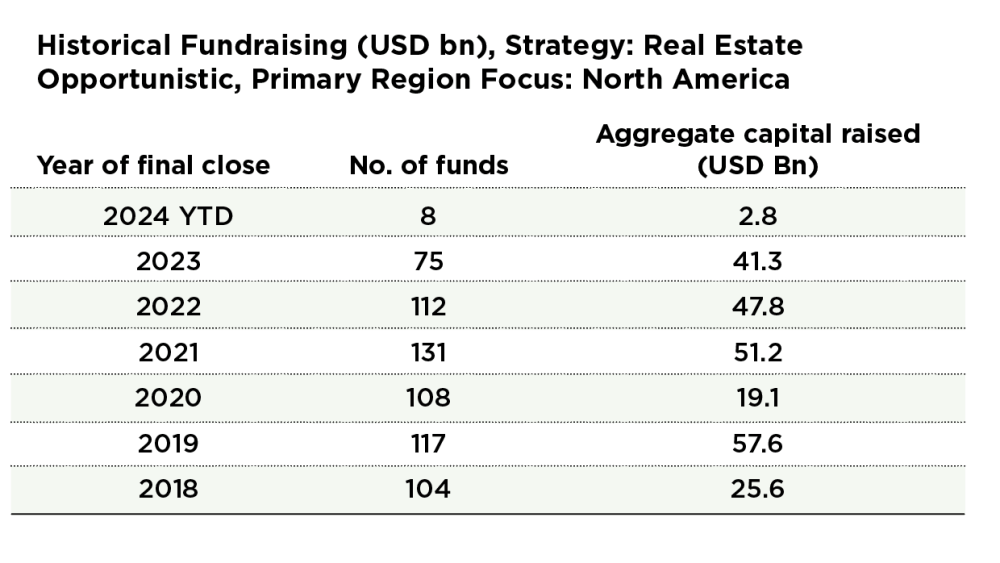

Fundraising and the amount of capital sitting on the sidelines that’s ready to deploy is near record highs,” says Aaron Jodka, director of research | U.S. Capital Markets at Colliers. According to Preqin, there is roughly $260 billion in capital that is targeting North American real estate today. That level is down from the high-water mark of $283 billion in 2022, but still a sizable volume by historical standards. “At the end of the day, we’re still at tremendous amounts of investable capital, and the vast majority of this is focused on debt, value-add, and opportunistic strategies,” he says.

Source: Opportunistic Funds Take Aim at Looming Commercial Real Estate Distress – Urban Land Magazine