The founder of Emerald Equity Group had bought scores of rent-stabilized buildings, aiming to free units from regulation and charge market-rate rents. When the legislation snuffed out that strategy, Emerald properties in 2020 faced foreclosure, then bankruptcy.

The properties’ cash flow has been eroded by rising expenses and nonpaying tenants, according to loan servicer commentary.

Even owners who bought stabilized buildings with no intent of deregulating units have been crushed by the rent law’s caps on rent increases. Hikes are now limited to what the Rent Guidelines Board approves each year, plus minimal increases to reimburse improvement costs. In 2020, the board imposed a year-long freeze, and subsequent increases lagged the soaring cost of insurance, property taxes and maintenance.

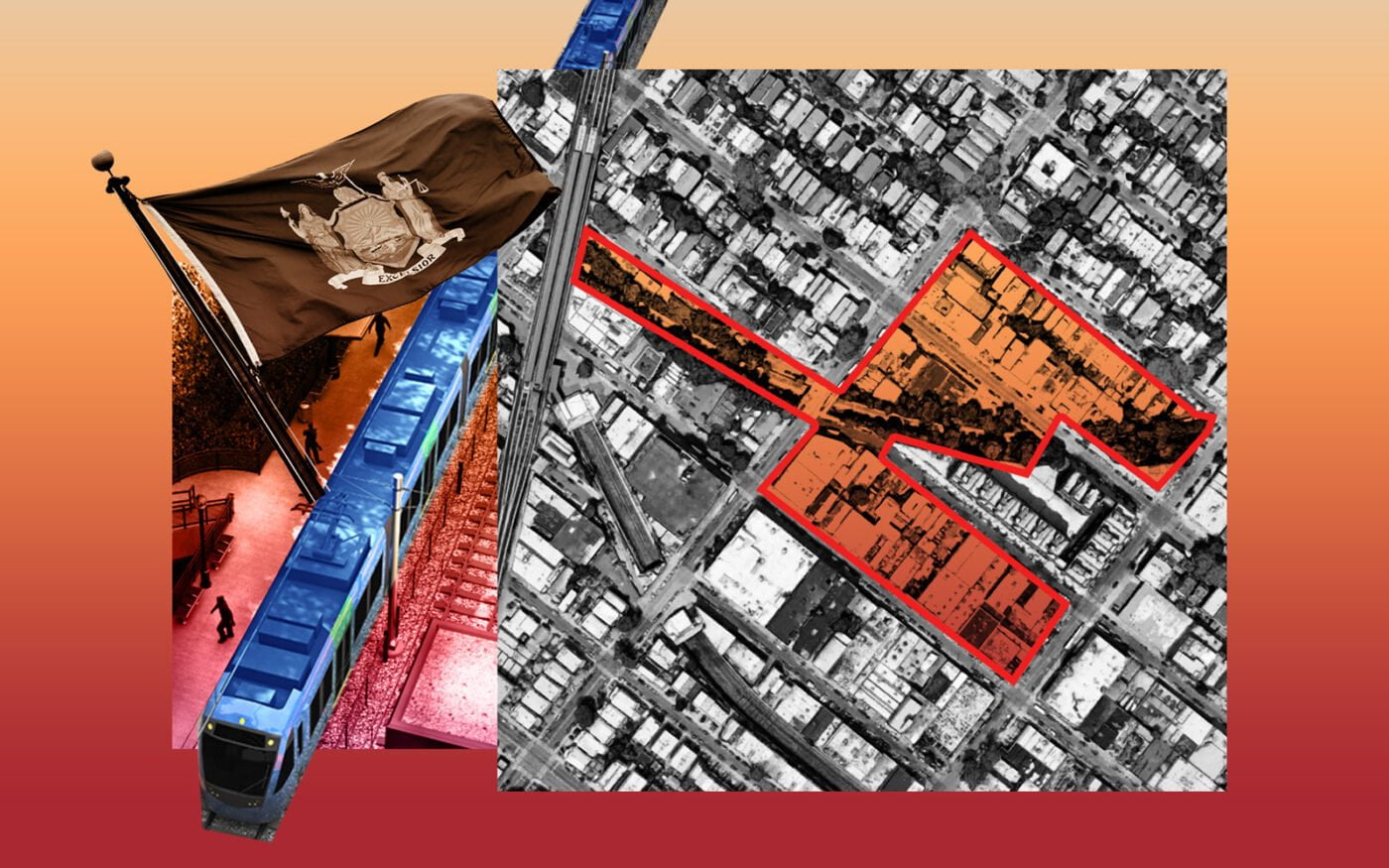

Source: Emerald Equities Defaults on $100M Rent-Stabilized Portfolio