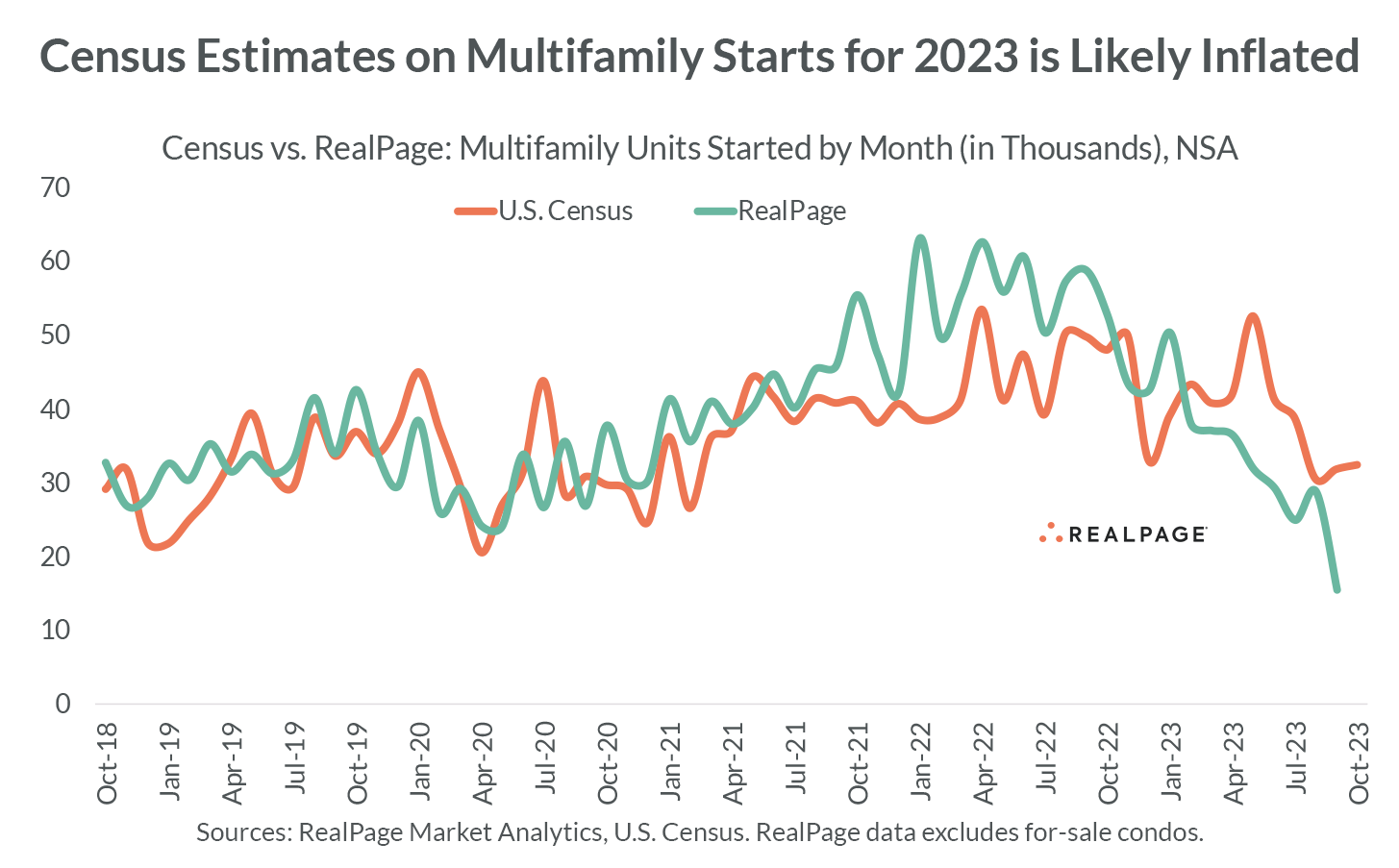

After 2024, we should see a massive plot shift, as the multifamily market goes from supply>demand in 2023-2024 to (assuming a decent economy) demand>supply in 2025-2026 and possibly into 2027. In turn, that could lead to falling vacancy and rebounding rents.

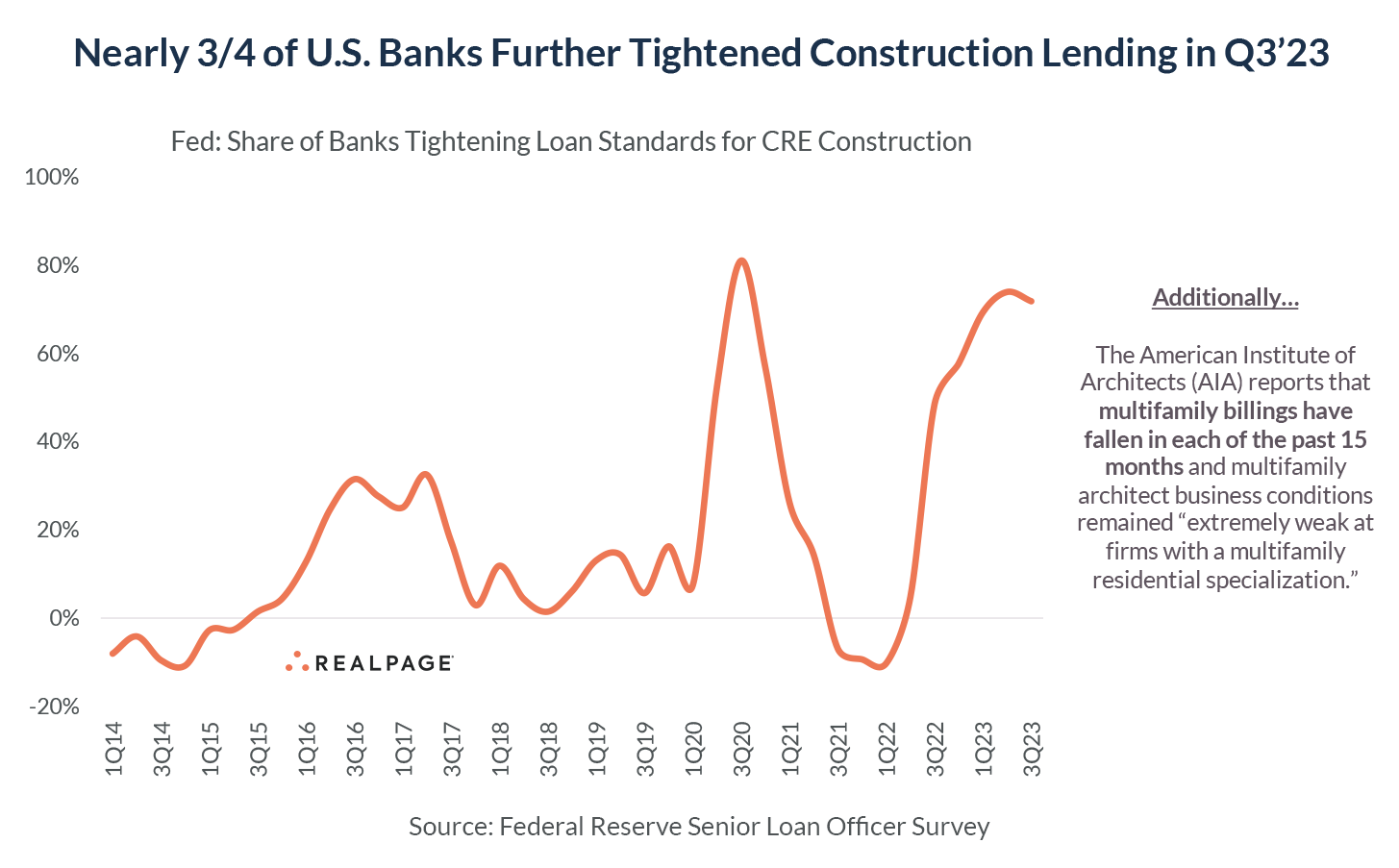

It’s difficult to see a scenario where starts can meaningfully re-accelerate prior to 2026, which means we should see a few years of lower supply. Developers need to see some combination of lowering rates, steadying/rising rents, falling construction costs, stabilizing asset values, and reinvigorating banks.

Source: New Census Data Likely Overstating Starts | RealPage Analytics