Housing costs remain one of the biggest challenges for many American households. While the root cause of high housing costs is the under-supply of housing, insufficient competition in the housing industry exacerbates the costs significantly. In this CEA analysis, we quantify the anticompetitive impact of algorithmic pricing on rents across the country to demonstrate how households are harmed when competition in rental housing is weakened. We find that anticompetitive pricing costs renters in algorithm-utilizing buildings an average of $70 a month. In total, we estimate the costs to renters in 2023 was $3.8 billion. This estimate is likely a lower bound on the true costs.

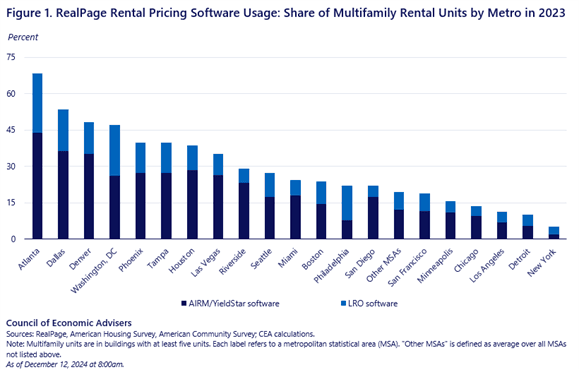

Our findings underscore the importance of the Biden-Harris Administration’s efforts to lower costs and promote competition. Last year, the Administration’s crackdown on junk fees in rental housing markets led to increased price transparency on major rental listing platforms, making it easier for renters to compare prices. Earlier this year, the FTC and DOJ filed a joint legal brief explaining that the law banning price fixing applies even when an algorithm is used for pricing instead of a human, and even if the algorithm is only a price recommendation. In August, the DOJ, together with eight State Attorneys General, filed a lawsuit against technology company RealPage for its alleged monopolization of the market for software that landlords use to price apartments, and for decreasing competition among landlords.[1]

Algorithmic pricing weakens competition because it can facilitate price coordination among landlords who would otherwise be competing. Our analysis indicates that if price coordination was eliminated, there would be an economically meaningful decrease in price mark-ups for rental units using pricing algorithms.

Source: The Cost of Anticompetitive Pricing Algorithms in Rental Housing | CEA | The White House